What are Pivot Points in Forex Trading

In order to become a successful forex trader, you need to be able to recognize different patterns and levels in the forex markets. You also need to understand the pivot points and how they’re important for your trading strategy. Here is all you need to know about pivot points:

What are Pivot Points

The traders that participate in the commodity markets created an indicator known as a pivot point. It is applied to the task of locating possible turning spots. Pivot points are used by day traders in the foreign exchange market and other markets to forecast expected levels of support and resistance, and hence possible turning points from positive to negative or vice versa.

How do Pivot Points Work?

Pivot points, on the other hand, are designed to anticipate turning points in the market, as opposed to most other technical indicators. In the foreign exchange market, pivot points are determined by taking into account the entirety of a trading session that lasts 24 hours, with the price at the end of the U.S. trading session serving as the closing price. Forex signals are a great way to get experts to analyze the pivot points for you and send you the best positions.

Day traders rely heavily on various forms of technical analysis, the majority of which are underpinned by pivot points. It is something of a self-fulfilling prophesy, in the sense that the fact that they are so widely used as an indicator of market activity at the levels in question contributes to that popularity. Calculating longer-term pivot points is possible using weekly, monthly, quarterly, or yearly prices instead of only annual prices.

Do you Need a Strategy with Pivot Points?

Traders still need a workable method, regardless of how accurate pivot points are in predicting turning moments, in order to win with them consistently. It is necessary to have an entry technique, a stop-loss trigger, and either a profit objective or an exit signal for it to be considered a trading system. Luckily, forex signals provide all these values to you when they send you a position after you subscribe to their service.

Pivot points are used by certain day traders as a means of determining levels of entry, stops, and profit-taking. These traders do this by attempting to discern where the bulk of other traders may be doing similar to themselves. Calculators for determining the pivot point in forex trades may be found for free all over the internet, including on the websites of retail forex brokers and independent websites.

Top Strategies for Pivot Points

While pivot points are a great way of determining the right points of entry or exit in a market, this strategy does not work well on its own and needs to be used in conjunction with other forex trading strategies to give you a fighting chance at success. Here are the top strategies to use with pivot points:

Camarilla

The Camarilla pivot point trading technique makes use of a straightforward expansion of an indicator that is known as the classical pivot point. This indicator provides traders with suggestions regarding critical levels of support and resistance.

The Camarilla pivot point trading technique employs a total of four levels of support and four levels of resistance. It also employs levels that are much closer together than the other varieties of the pivot. Because of the close closeness of its levels, this approach is popular among traders who focus on the short term.

A market that is considered to be trading sideways is referred to as a range by traders. Among range traders, camarilla points can often be quite desirable. Traders who employ the range reversal strategy watch for the price to move in one of two directions: either toward a point of resistance or support.

Traders would typically discard this approach in favor of one better suited to dealing with unpredictable price changes or a trend strategy as market conditions become more turbulent. A consistent price movement that remains either higher or lower for a certain amount of time is referred to as a trend. The Camarilla pivot point trading approach may be particularly helpful in trending markets, and it can indicate to traders crucial levels at which to enter, halt, and limit their positions.

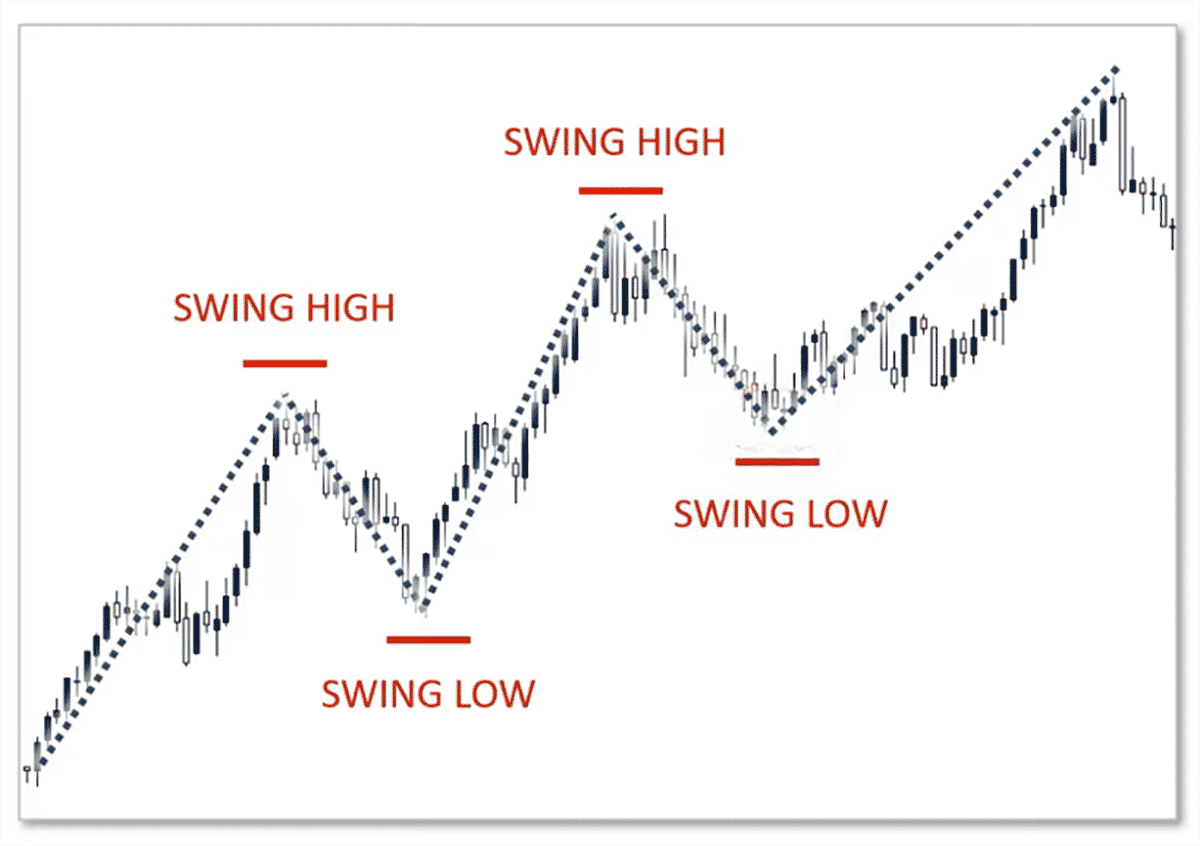

Swing Trading

The term “swing trading” refers to a trading method in which investors seek to profit from large price fluctuations by taking advantage of “swings” in market direction. Swing traders will often enter transactions that last anywhere from one to seven days.

Such movements can, in many instances, be significant, which means that a trader may have a decent possibility of making a profitable deal. The use of a pivot point trading technique in swing trading is quite similar to the tactics I just explained above.

Swing traders, on the other hand, typically employ certain time frames. Swing traders often utilize pivot points that are calculated over a period of more than one day, such as weekly or even monthly, depending on the trader’s intended holding duration for an open position.

Day traders typically use pivots that are calculated daily. Traders can build a trading strategy based on a weekly pivot point or a trading strategy based on a monthly pivot point by using various timeframes.

Intraday Trading

The term “intraday” refers to fluctuations in the price that takes place within the course of a single trading day. Therefore, short-term and day traders place a significant emphasis on intraday price changes.

Which pivot points are most useful for use during intraday trading? As a result, a pivot point trading strategy that concentrates on intraday price swings would employ pivots throughout a more restricted period of time.

Final Verdict

Pivot points are a useful tool that is used to determine where support and resistance levels are located in a market. Pivots, when used in conjunction with other techniques of technical analysis, make it possible to construct trading strategies that are successful.

In conjunction with trend trading or channel trading systems, pivot points are a supplemental tool that traders utilize. The primary benefit of this system is that it eliminates the need to manually compute the levels. One disadvantage of using the Pivots indicator is that it does not construct trendlines; rather, it just indicates horizontal levels.

When trading with pivot points, it is important to keep an eye on the underlying fundamentals and to verify that a trend reversal has occurred by utilizing other trading tools and chart patterns. Subscribing to forex signals is a great way to utilize expert knowledge and become a successful forex trader.

Also read: Credit Scores: Expectations vs. Reality